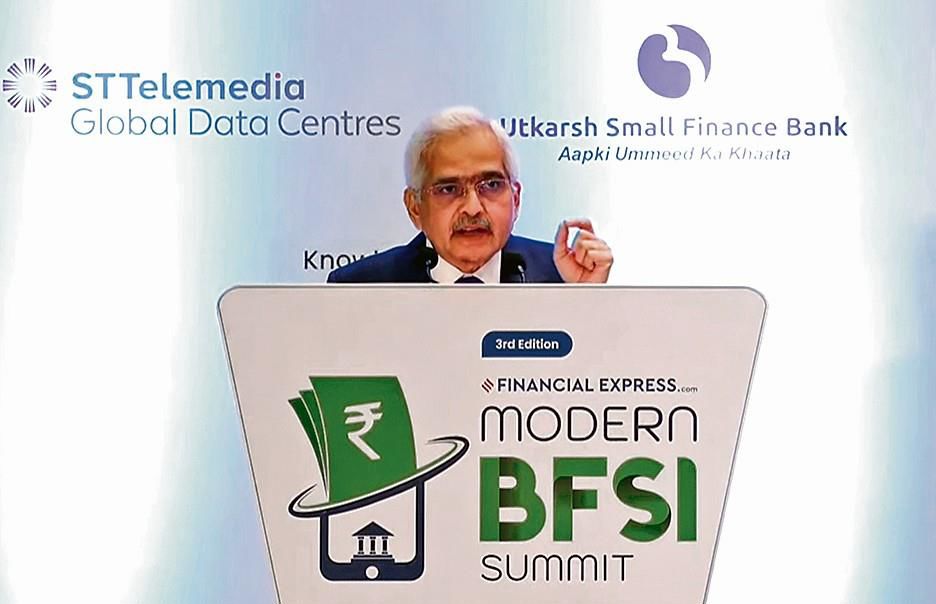

Coordination with govt helped fast revival of economy: RBI Governor

Mumbai, July 19

Governor Shaktikanta Das on Friday said the Reserve Bank of India’s (RBI) relations with the government have been “smooth” during his nearly six-year term, and credited the close coordination between the two for the quick revival of the economy after the pandemic.

Speaking at an event here, the bureaucrat-turned-central banker said nobody has expected him to be a “cheerleader” for the government during his term. “I am saying from my experience. Nobody expects RBI to be a cheerleader. I have had no such experience,” he said, responding to a specific question about a lament made by one of his predecessors in a recent book.

Asked if he is open for a new term at Mint Road, Das said he is very focused on the current assignment and does not think of anything outside that.

Das said the RBI is optimistic that its estimate of 7.2 per cent growth for FY25 will be met, and added that with steady growth, the focus of the policy has to be “clearly and unambiguously” on inflation. The inflation elephant is taking pauses and grudgingly moving towards the forest or the 4 per cent target in a unidirectional way, he added.

He asked the banks to be watchful on the lag between credit and deposit growth and advised that the former should not exceed the latter.

The Governor also warned that the financial system can get exposed to “structural liquidity issues” due to the lag between the credit and deposit growth.

Amid concerns about Mule accounts being used by fraudsters, Das asked banks to strengthen their customer onboarding and transaction monitoring systems to check unscrupulous activities.

The RBI is working with banks and law enforcement agencies to check Mule accounts and digital frauds, he added.