Bull run continues

Mumbai, May 16

Markets soared to record-smashing heights for the second straight session today as investors remained enthused by the early onset of monsoon amid quarterly earnings cheer.

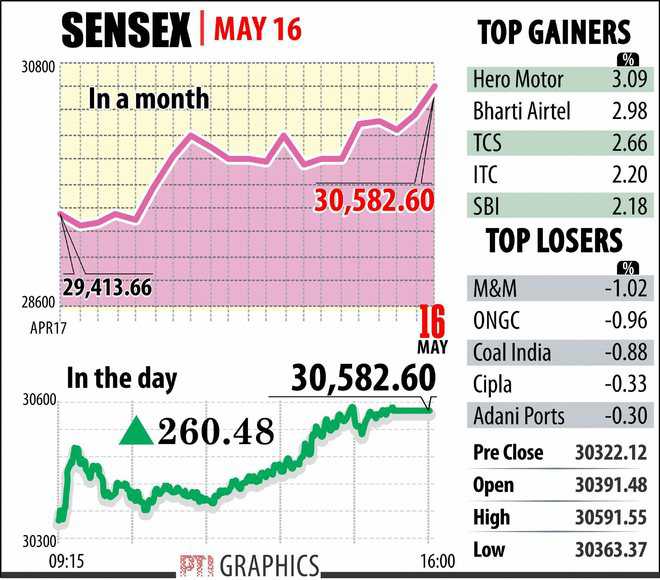

Benchmark Sensex finished at a fresh lifetime high of 30,582 while the broader Nifty closed above the 9,500-mark for the first time.

Both indices had hit record highs in yesterday’s trade as well.

Earlier this week, the weather office said Southwest monsoon has covered the Nicobar Islands and the entire south Andaman Sea, three days ahead of its normal onset date.

Encouraging quarterly earnings and upbeat global cues further fuelled the momentum, brokers said.

The 30-share Sensex opened on a strong footing and zoomed to a new peak of 30,591.55, before winding up 260.48 points higher at 30,582.60, breaching its previous record close of 30,322.12 points reached yesterday.

It also went past its previous intra-day record of 30,366.43 points hit on May 11.

The 50-share NSE Nifty too maintained its bull run and touched a new peak of 9,517.20. It finally settled 66.85 points up at 9,512.25, surpassing its previous closing high of 9,445.40, recorded yesterday.

Meanwhile, foreign portfolio investors (FPIs) bought shares worth a net Rs 235.33 crore yesterday, while domestic institutional investors (DIIs) sold shares worth a net Rs 65.77 crore, as per provisional data released by the stock exchanges.

“The market has crossed another hurdle with a new high, given good corporate results and... early arrival of monsoon which shredded off the worries over premium valuation.

“But the concern is that non-performing sectors like telecom, IT and pharma are also participating in the rally which may cause vulnerability in the near term,” said Vinod Nair, Head of Research, Geojit Financial Services.

Investor sentiment also got a boost after Morgan Stanley said the Indian economy is entering a “productive growth phase” and real GDP growth is likely to rise to 7.9% by December, driven by external demand, improving corporate balance sheets and private capex recovery.

Reflecting the upbeat mood, barring metal, all the sectoral indices led by teck, FMCG, IT, auto and consumer durables ended in positive zone.

Overseas, Asian stocks ended narrowly mixed after a surge in oil lifted US stock indices to fresh highs. — PTI