Amit Sethi

The Budget 2017 brought in big tax-related changes in the realty market. The announcement related to the capping of loss deduction from the let-out property to Rs 2 lakh could have great impact on the realty market and especially on the realty investors.

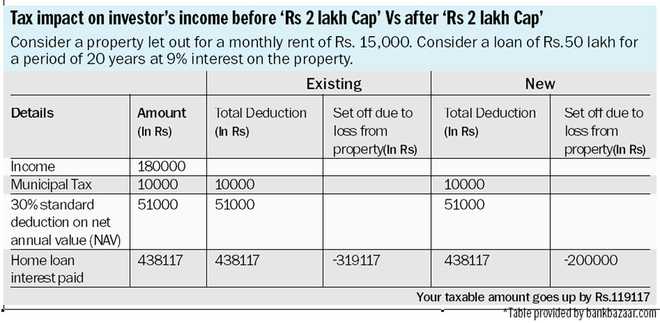

Under the present rules, an owner can claim complete deduction on set off from losses for house property that is let-out. However, in the Union Budget 2017-18, the Finance Minister has proposed that the deduction a homeowner can claim on set off from losses be restricted to Rs 2, 00,000 per annum. The balance loss will be allowed to be carried forward for set off against house property income for a subsequent period of 8 years.

What is capping of Loss deduction?

The Income Tax department follows a thumb rule that if you have two properties, then one is considered as self-occupied and the other one is considered as Let out property. The cap on loss deductions applies to this second property that is let out.

Adhil Shetty, CEO, BankBazaar.com explains, “When you file your Income Tax Returns, any income that you derive from your house property is clubbed with the total income under ‘Income from House Property’. This income is usually in the form of rent in the case of the let-out property. However, it is not essential that you only gain income from the property. If you have a home loan on the property and the interest outflow of the home loan is more than the rental income, then you end up incurring a loss from the let-out property”.

Shetty illustrates, “Consider you have a second house that provides you a rental income of Rs 2 lakh per year. If the interest outflow due to the home loan is Rs 8 lakh per year, then the loss on the housing property comes to Rs 6 lakh. Presently, you can claim deduction on the entire Rs 6 lakh. However, now the deduction benefit stands capped at Rs 2 lakh. The additional loss of Rs 4 lakh, can be carried forward to be set off against house property income of the subsequent 8 years.

The balance loss not set off in a particular financial year will be allowed to be carried forward for set off against house property income for a subsequent period of 8 years. This means even though the investor cannot reap the tax benefits in the current financial year, he would be eligible to claim the same in the subsequent years.

Impact on the realty sector

The major motive of the government behind this decision was to subsidise first- time homebuyers instead of second home buyers. Letting second home buyers claim unlimited losses from their second home interest costs was a major loss of tax revenue for the government. Due to the change, investors may stay away from the market, which could lead to correction in pricing and thereby promote first time home buyers to buy properties.

“This move is likely to hurt the investor sentiment and will affect the investor-led demand in the real estate sector. Buying a second home as a tax saving mechanism will be an unattractive proposition now, especially in markets that have a lower capital appreciation. If a substantial number of second-home buyers stay away from the market, we could see softening in property prices. It will boost the affordable housing segment in the near future, but high-end residential real estate could witness a slowdown”, opines Ajay Jain, Executive Director – Investment Banking & Head Real Estate Group Centrum Capital Limited.

There is no doubt that the government’s move will have some kind of impact on the real estate market and only after a few years, it would be clear to some extent whether it would prove to be a positive or a negative step for the home buyers and investors. At present, the move seems to be inclined in favour of the end users, whereas unpromising for the investors. Lower cost of borrowing and curb in long term capital gain tenure from 3 to 2 years are two things that would continue to propagate the interest of realty investors in the future.